📌 Overview

Phymatry provides step-by-step NCERT solutions for all 15 chapters of Class 11 Accountancy, featuring:

-

Solved numericals with journal entries

-

Format-ready balance sheets and trial balances

-

CBSE/Board exam pattern practice

-

Practical accounting case studies

📚 Chapter List & Solutions

| Chapter | Key Topics | Exercises | Solutions PDF | Video Lessons |

|---|---|---|---|---|

| 1. Introduction | Accounting terms, GAAP | Q1-Q12 | [Download] | [Watch] |

| 2. Theory Base | Accounting standards, Concepts | Ex 2.1-2.8 | [Download] | [Watch] |

| 3. Recording Transactions | Journal, Ledger, Subsidiary Books | Ex 3.1-3.25 | [Download] | [Watch] |

| 4. Bank Reconciliation | BRS Format, Causes of Differences | Ex 4.1-4.15 | [Download] | [Watch] |

| 5. Depreciation | SLM, WDV Methods | Ex 5.1-5.20 | [Download] | [Watch] |

| 6. Bills of Exchange | Accounting for Bills | Ex 6.1-6.18 | [Download] | [Watch] |

| 7. Rectification of Errors | Suspense Account | Ex 7.1-7.12 | [Download] | [Watch] |

| 8. Financial Statements | Trading & P&L Account | Ex 8.1-8.30 | [Download] | [Watch] |

| 9. Adjustments | Closing Stock, Outstanding Expenses | Ex 9.1-9.15 | [Download] | [Watch] |

| 10. Computers in Accounting | Accounting Software Overview | Ex 10.1-10.5 | [Download] | [Watch] |

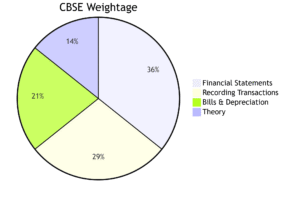

📊 Exam Analytics

🎯 Key Features

✔ Ready Formats: Balance sheets, Trial balances

✔ Numerical Banks: 200+ solved problems

✔ Visual Guides: Flowcharts for accounting cycles

✔ Exam Alerts: Common journal entry mistakes

📌 Subject-Specific Notes

-

High-Weightage:

-

Financial Statements (25 marks)

-

Recording Transactions (20 marks)

-

-

Tricky Areas: Adjustments, BRS

-

Must-Practice: Depreciation calculations

❓ FAQs

Q: How to master ledger posting?

A: Use our “T-Account Templates” with color-coded rules

Q: Are GST entries included?

A: Yes! Chapter 3 & 8 cover GST accounting

Q: Best reference book?

A: NCERT + DK Goel for extra practice

🚀 Beyond NCERT

-

CA Foundation Prep: [Accounting Basics]

-

Digital Accounting: [Tally Prime Guide]

-

Quick Formulas: [Accounting Ratios]